In the dazzling and often volatile world of cryptocurrencies, mining remains the bedrock of decentralized finance. Yet, as anyone familiar with Bitcoin (BTC) or Ethereum (ETH) will tell you, success in mining hinges on much more than simply acquiring the most powerful mining rig. Selecting the right crypto mining hosting solution is a critical decision, intimately tied to understanding and managing the true costs behind mining operations. These costs extend beyond mere electricity bills or upfront hardware investments—they encompass a labyrinth of factors that can dramatically impact profitability and operational stability.

At its core, crypto mining functions as a high-stakes race to solve complex cryptographic puzzles, validating transactions and securing blockchain networks. Miners deploy specialized machines—ASIC miners for Bitcoin or GPUs for Ethereum—to perform these computational tasks. Yet, owning the best rigs is only the first triumph; choosing how and where to host them is equally crucial. Mining hosting services provide miners with physical locations, infrastructure, cooling systems, and network stability, allowing them to focus on optimization rather than maintenance. However, each hosting provider offers different pricing structures and cost paradigms that miners must decode before committing resources.

Electricity costs stand out prominently in this financial jigsaw. Mining rigs gulp vast quantities of power, and depending on regional rates, electric bills can eclipse hardware expenses over time. Hosting centers often negotiate bulk energy contracts, passing savings on to clients, but these arrangements vary widely. Moreover, some services may offer dynamic pricing based on consumption peaks or employ renewable energy sources, adding complexity but also sustainability to the cost equation. Miners must inquire: does the hosting provider leverage green energy, or are fossil fuels the main source? This not only affects environmental impact but potentially influences long-term cost stability amid fluctuating energy markets.

Beyond power lies infrastructure—cooling, security, maintenance, and network connectivity—all essential to uninterrupted mining. Heat generated by mining rigs can be extreme, making efficient cooling systems indispensable. This is where mining farms excel, using advanced liquid cooling or strategically designed airflow to maintain optimal temperatures. Hosting solutions differ: some provide basic rack space with user responsibility for upkeep, while others offer comprehensive “turnkey” services, including real-time monitoring and rapid hardware replacement. Each service level corresponds with a price point that miners must weigh against potential downtime or hardware degradation costs.

Consider also the geographic location of hosting providers. Proximity to reliable internet backbone infrastructure can tilt the edge in mining speed and latency, especially vital in fierce competition for block rewards. Legal and regulatory frameworks also matter—miner-friendly jurisdictions with clear cryptocurrency regulations and tax benefits can significantly influence long-term sustainability. Countries with favorable power grids and cool climates naturally become hotspots for mining farms, creating clusters that reinforce economies of scale and innovation. Thus, miners evaluating hosting solutions must analyze how location-driven operational costs and legal considerations shape their overall strategy.

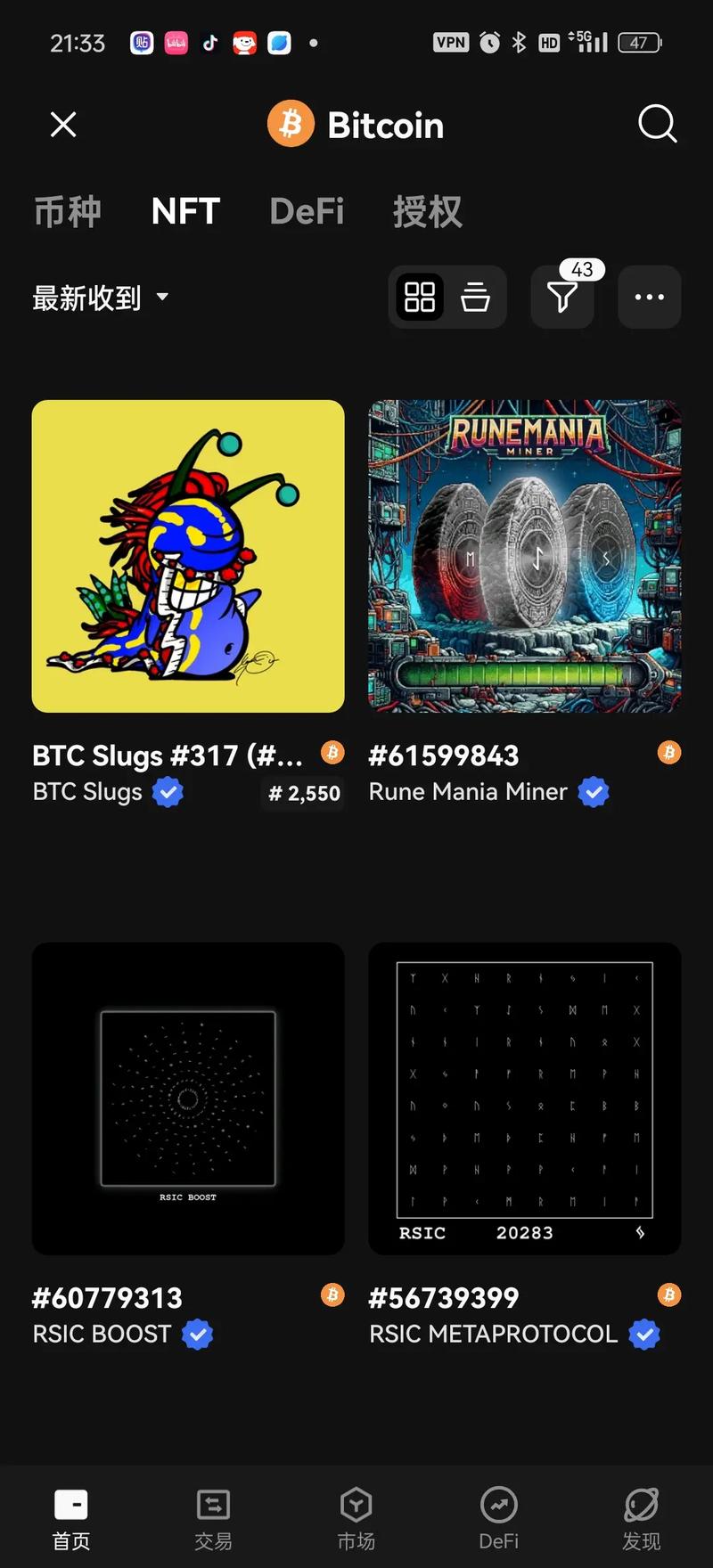

Delving deeper, miners should assess network and pool fees, firmware support, and even potential equipment resale or upgrade options offered by hosting firms. Bitcoin’s volatility and the rise of alternative coins such as Dogecoin (DOG) or Ethereum demand agility. Hosting providers who facilitate easy hardware reconfiguration or multi-coin mining capabilities can provide miners with the flexibility to pivot according to market conditions, preserving profitability amid shifting tides. Moreover, mining hosts that integrate with prominent cryptocurrency exchanges streamline revenue management, simplifying the task of converting mined coins into usable fiat or alternative cryptocurrencies.

One often overlooked component is the intangible cost of latency in transaction confirmations. Miners connected to suboptimal networks may face delayed block propagation, jeopardizing their chance to claim rewards before competing nodes. Hosting providers dedicated to high-speed, low-latency environments grant their clients a competitive advantage—yet, such premium service naturally commands a premium price. Balancing latency costs against potential rewards requires miners to not only calculate raw expenses but also strategize operational efficiency to maximize return on investment.

Within this multifaceted landscape, mining rig hosting is a dynamic intersection of technology, finance, and geography, demanding astute decision-making. Miners must look beyond sticker prices, diving into contract terms, service level agreements, hidden fees, and innovation potential. Thoughtful choices here impact not only current profitability but the resilience of mining operations against regulatory shifts, technological obsolescence, and fluctuating coin values.

More than simply a space to plug in their miners, hosting services act as strategic partners in modern cryptocurrency mining. They shape power consumption profiles, influence hardware longevity, and provide a foundation for expansion or diversification into emerging coins. Whether focusing on the titans like Bitcoin and Ethereum or dipping into niche altcoins such as Dogecoin, miners must interpret hosting costs as a key variable in their broader economic models. Ultimately, understanding and scrutinizing these costs empower miners to navigate the tumultuous crypto seas with confidence and foresight, ensuring their rigs not only run but thrive.

Leave a Reply to cryptoKING Cancel reply